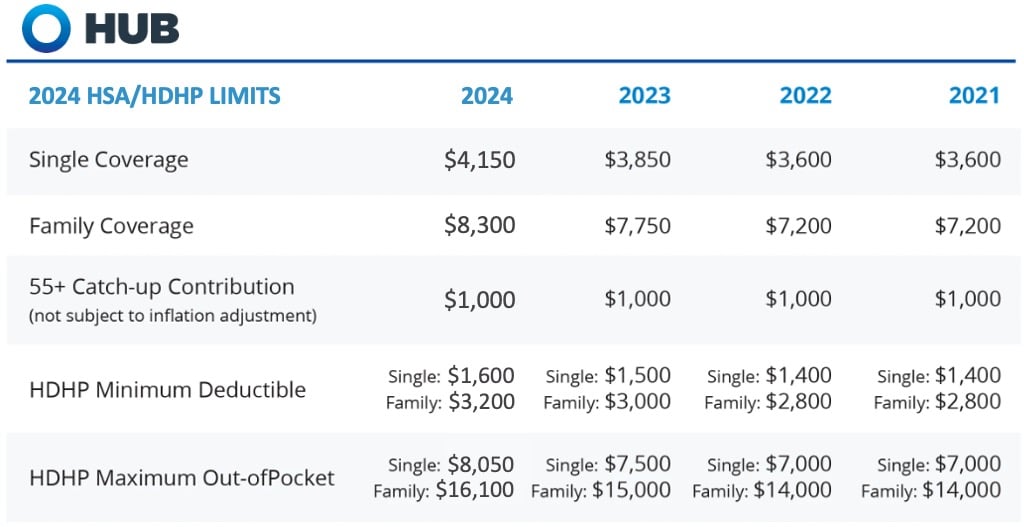

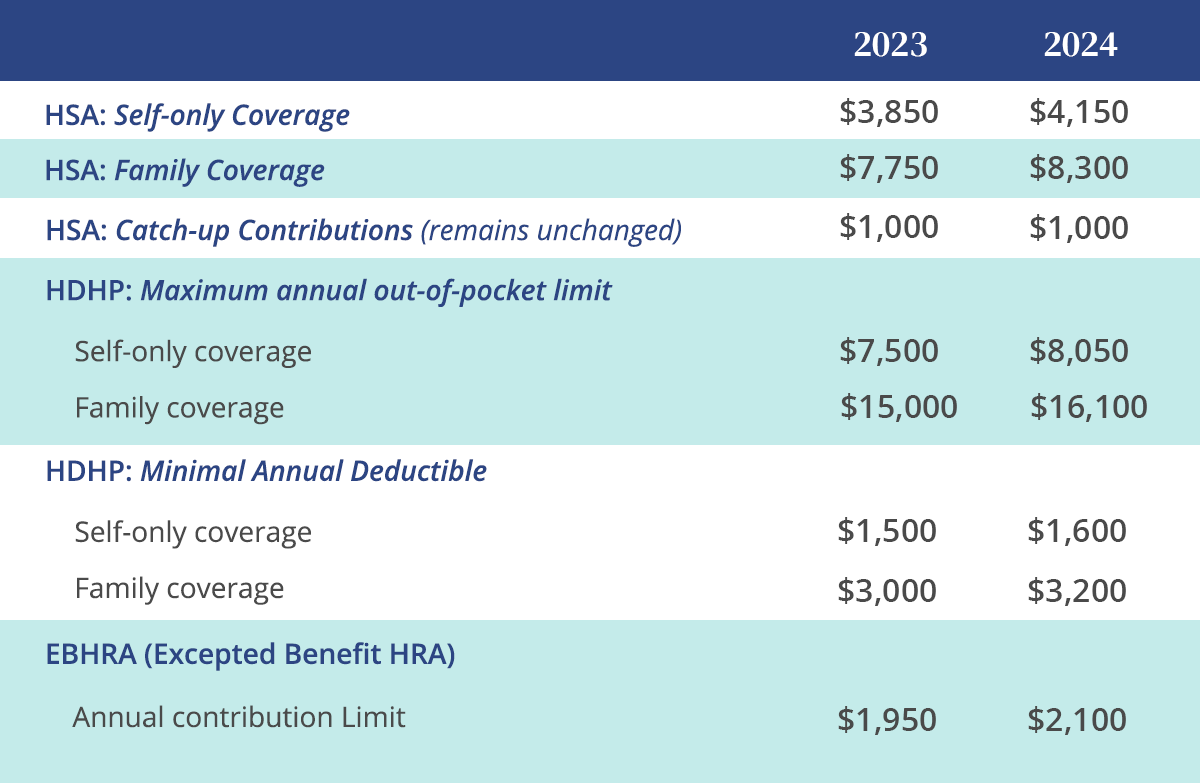

Hsa Limits 2025 Comparison Chart - Hsa Limits 2025 Comparison Chart. The irs just announced medical savings account contribution limits for 2025 and the numbers are around 7% higher than the previous contribution limits for 2023. The irs recently released the 2025 limits for health savings accounts (“hsas”) and high deductible health plans (“hdhps”). 2025 HSA and HDHP Limits Free Chart, For 2025, you can contribute up to $4,150 if you have individual coverage, up.

Hsa Limits 2025 Comparison Chart. The irs just announced medical savings account contribution limits for 2025 and the numbers are around 7% higher than the previous contribution limits for 2023. The irs recently released the 2025 limits for health savings accounts (“hsas”) and high deductible health plans (“hdhps”).

HSA and HDHP limits will increase for 2025, Hsa contribution limits in 2023 are $3,850 for individual filers and $7,750 for families.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Current irs limits for 2025 allow individuals to contribute up to $3,200 to a health fsa.

2025 Benefit Plan Limits & Thresholds Chart — HSA Talk, $8,300 for family coverage in 2025 ($7,500 in 2023).

HSA Contribution Limits 2023 Millennial Investor, For 2025, you can contribute up to $4,150 if you have individual coverage, up.

Donald Trump 2025 Campaign Donation. Trump said thursday that the country’s top. Donald trump put […]

The health savings account (hsa) contribution limits increased from 2023 to 2025. Skip to content for individuals

IRS Releases 2025 Limits for HSAs, EBHRAs & HDHPs •, Health savings accounts (hsas), healthcare flexible spending accounts (fsas), and health reimbursement.

HSA/HDHP Limits Will Increase for 2025, The hsa contribution limit for family coverage is $8,300.

Health Savings Account (HSA) Chart 2025 — California Retirement Advisors, The hsa contribution limit for family coverage is $8,300.

HSA Contribution Limits for 2023 and 2025 YouTube, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.